Business Insurance in and around North Vernon

North Vernon! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

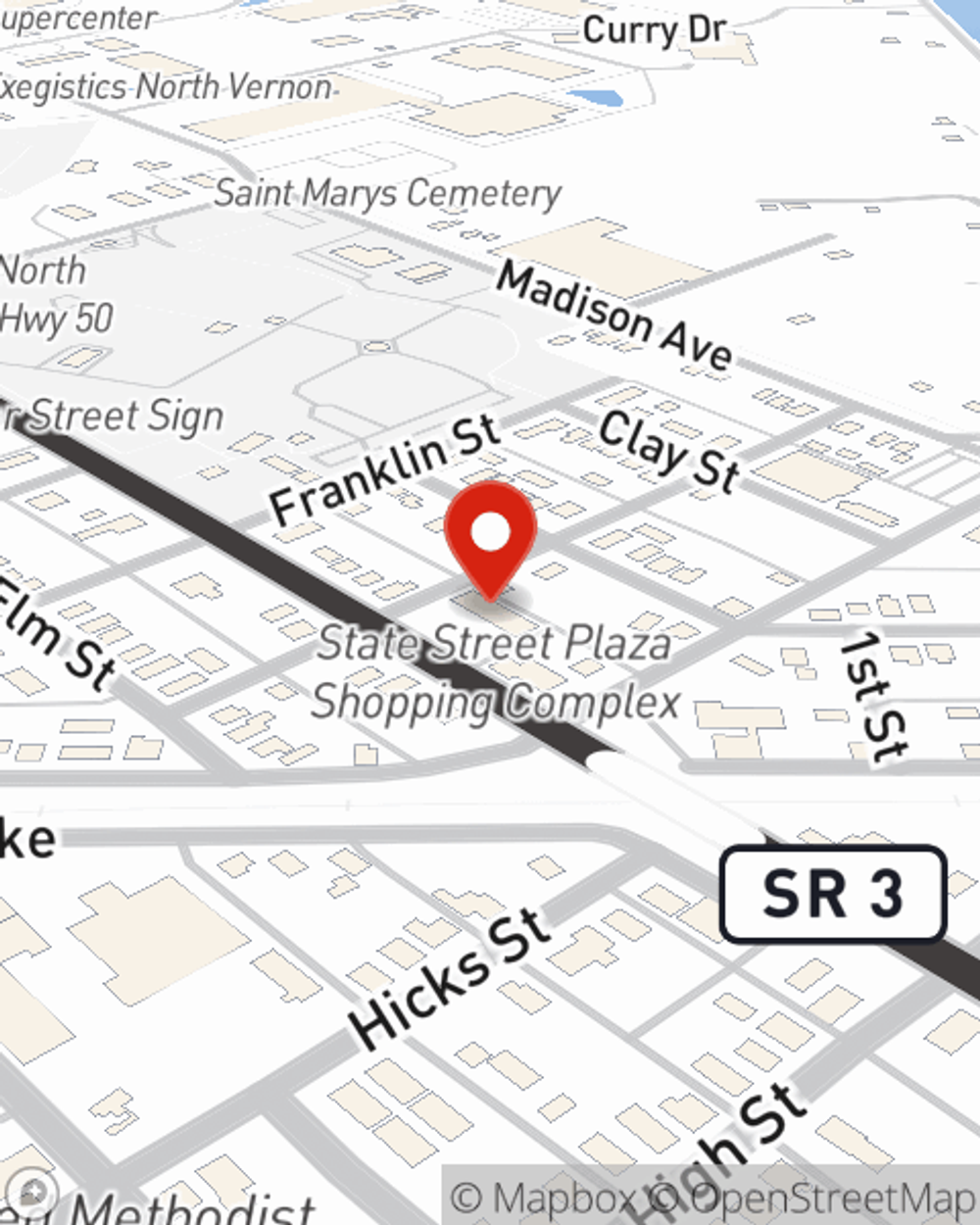

- North Vernon, IN

- Columbus, IN

- Jennings County

- Versailles, IN

- Ripley County

Coverage With State Farm Can Help Your Small Business.

Whether you own a a bakery, a fabric store, or a lawn care service, State Farm has small business insurance that can help. That way, amid all the various decisions and moving pieces, you can focus on your next steps.

North Vernon! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Customizable Coverage For Your Business

Your business thrives off your determination commitment, and having great coverage with State Farm. While you support your customers and put in the work, let State Farm do their part in supporting you with worker’s compensation, artisan and service contractors policies and commercial auto policies.

As a small business owner as well, agent Jim Apple understands that there is a lot on your plate. Reach out to Jim Apple today to chat about your options.

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Jim Apple

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.